PORTLAND, Ore. — A KGW investigation found tens of thousands of Oregon taxpayers have had money garnished from their state tax refunds due to a little-known program that allows the state to collect old unpaid debts, such as parking tickets or court fees.

Each year, the Oregon Department of Revenue collects roughly $27 million in unpaid debt on behalf of dozens of state agencies and local governments. The Oregon Judicial Department (OJD) is the largest user of the program, extracting nearly $8 million annually in delinquent fines and fees.

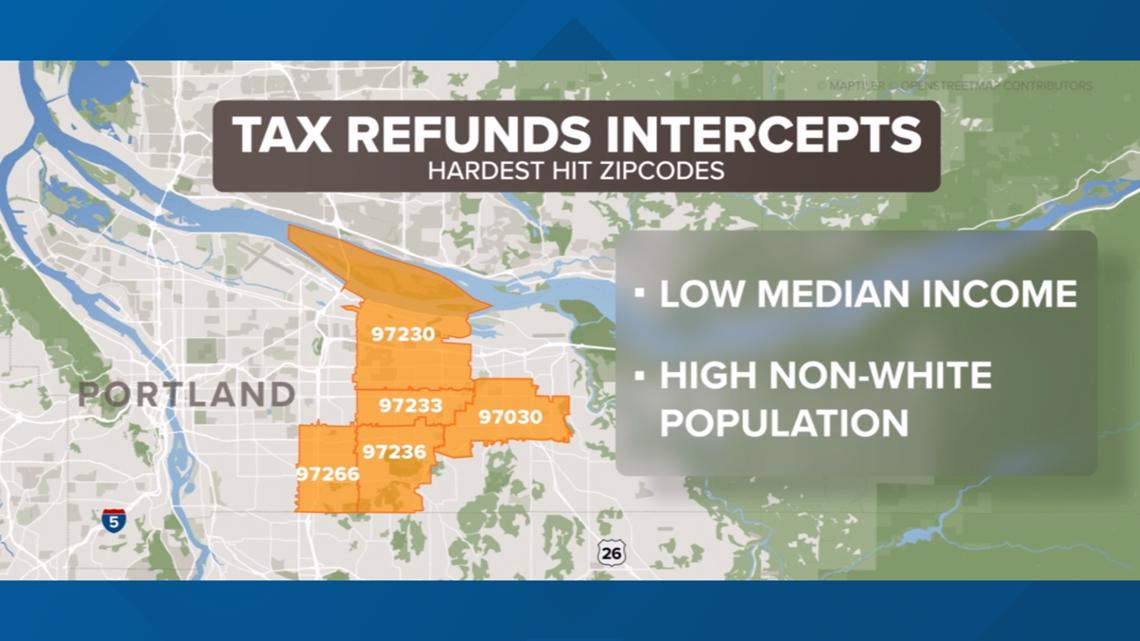

Analysis of state records by KGW suggests the impact of this program has fallen disproportionately on the poor and minority communities.

From 2019 to 2021, approximately 61% of the tax refunds intercepted within Multnomah County on behalf of state courts were intended for residents in zip codes where the median household falls below the county’s overall median household income of $71,425, according to Census Bureau data.

Roughly one-third of the tax-refunds intercepted in Multnomah County for unpaid tickets or court fees came from just five zip codes. Those neighborhoods — including Centennial, Outer Southeast, Wilkes/East Portland, Lents and Gresham – have some of the lowest median incomes in the county and highest non-white populations.

“It’s almost like it is set up to keep people in their poverty status and from moving forward,” said Aliza Kaplan, law professor at Lewis and Clark and director of the Criminal Justice Reform Clinic.

In March, Jerome Andre received a letter from the state explaining a good portion of his tax refund would be garnished to pay off two tickets he received in 2005 for not having fare on TriMet.

“I was homeless when I got the tickets,” explained Andre.

The Portland man said he’d forgotten about the old tickets and doesn’t recall receiving any collection notices.

“They have never sent me anything,” Andre said. Court records indicate Andre’s accounts ping-ponged between collection agencies. It’s not clear if those debt collectors ever contacted Andre by phone or mail.

Despite his efforts to overcome homelessness by getting a job rebuilding truck engines, buying a used car and securing a new apartment, the state was unrelenting in its pursuit of old debt. It garnished $314, or nearly one-third of his tax refund to pay off the TriMet tickets he received almost two decades ago.

“If people don’t have that full paycheck, if people don’t have that full tax refund, they are going to be in trouble and they are going to go further into a hole that they can never get out of,” said Kaplan of Lewis and Clark.

Unpaid parking tickets, court fines and fees often bounce between private debt collectors and the court for years before tax returns are garnished. In Oregon, this unpaid debt doesn’t come off the books for 20 years.

Chris Baum of Portland was shocked to receive a letter from the Oregon Department of Revenue in March warning he owed hundreds of dollars for three unpaid parking tickets in 2008 and 2009.

“I’m like wait a minute this is 14 years ago!” explained Baum. "It didn’t make any sense."

Baum said he doesn’t remember getting the tickets in downtown Portland nearly a decade ago, nor does he recall receiving any collection notices.

Unbeknownst to Baum, those unpaid tickets ballooned after court-imposed fees. For example, one parking violation issued in 2008 had grown to $254 from $50 originally.

In March, the state warned Baum that he needed to pay hundreds of dollars right away or his tax refund could be garnished.

“It’s never fun to be notified in a threatening manner that if you don’t do something immediately there will be negative repercussions beyond your control,” said Baum, who set up a $73 a month payment plan to avoid garnishment.

“I can pay it, but now I’ll have to decide is it going to make me not be able to do something else like buy gas for my car,” explained Baum.

Low-income individuals and families depend on annual tax refunds as a financial safety net, advocates argue.

Last year, an estimated 68,000 Oregonians did not receive their full tax returns because the state intercepted the money to pay off debts, according to revenue department records. At the same time, state economists announced a huge budget surplus.

In Oregon, debtors can enter payment plans to pay off fines and fees but if they miss payment or if the debt becomes delinquent, then their state tax refunds may be seized.

The money collected for traffic and parking violations is split between the state and agency which issued the ticket.

Multnomah County Circuit Court has $395 million in unpaid court debt on the books, and the balance grows every year. In 2021, the court recovered just a small fraction of that total — roughly $1 million in unpaid debt by garnishing tax refunds.

“We’re spending a ton of money having people chase after these people who haven’t paid,” said Kaplan, who argues the system is too heavy handed and ineffective.

The true cost of collecting court fines and fees is difficult to measure — both in financial terms and the burden for those who owe.

Oregon’s Chief Justice and Judicial Department have acknowledged court fines and fees are an issue that should be addressed.

“We will continue to examine the impacts of fines and fees, develop best practices for their imposition and take affirmative steps to ensure that they do not create unnecessary barriers or disproportionate outcomes,” explained the OJD strategic plan for 2020-21.

The Judicial Department has worked with the state legislature and within its own authority to help alleviate the impact of fines and fees, according to a OJD spokesperson.

Over the past few years, the court ended the practice of suspending driver licenses for unpaid fines, temporarily paused collections during the pandemic (since restarted), offered payment plans and extended the time before accounts are sent to collections.

Criminal justice reform advocates argue, there are options including an amnesty program — which would allow people with unpaid tickets the opportunity to pay ticket balances without having to pay the additional late fees that have accumulated. Additionally, some jurisdictions have explored a mandatory statute of limitations where tickets could be dismissed after a certain period and deemed uncollectable.

Advocates argue tax refund garnishment is particularly harmful because they don’t have protections for low-income residents.

“It’s really important to realize that there is a segment of our population who will never be able to pay,” explained Kaplan. “We need a better way to handle it.”