SALEM, Ore. — Oregon economists have finalized the state's total kicker fund for the current tax year, confirming earlier forecasts showing a record-shattering amount of surplus money to be distributed to taxpayers when they file their 2023 taxes next year.

The projected fund amount has surged steadily upward over the past 18 months, from roughly $3 billion in May 2022 to $5.5 billion a year later and then $5.6 billion in late August. The final total confirmed Monday by the Oregon Office of Economic Analysis pushes it up just a bit more to land at $5.61 billion.

The Oregon kicker can occur once every two years, although it's not guaranteed. The provision is triggered when Oregon's biennial revenue ends up being at least 2% higher than what state economists had predicted at the start of the budget cycle. If that happens, state law requires the surplus to be sent to taxpayers as a rebate.

How to check how much you'll get back

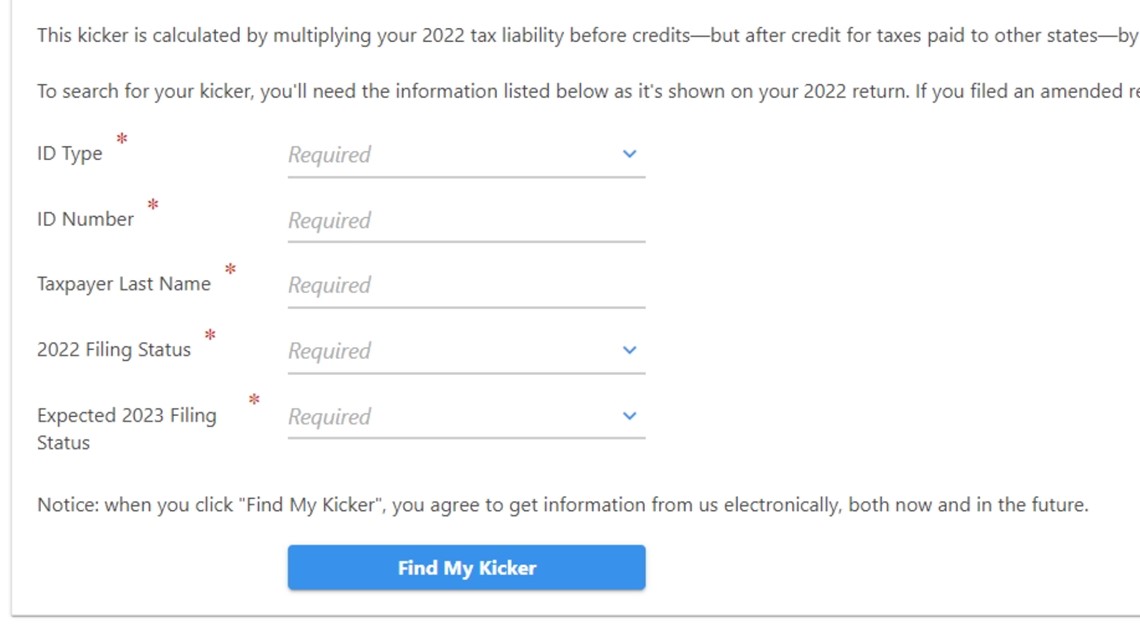

The amount sent to individual Oregonians is based on how much they paid in taxes for 2022, so higher income earners can expect to receive much larger kicker payments. The Oregon Department of Revenue has rolled out an online "What's My Kicker?" tool where taxpayers can look up their cut by entering their name, social security number and filing status.

Taxpayers can also manually calculate their expected kicker by multiplying their 2022 tax liability — line 22 on form OR-40 from 2022 — by 44.28%, which is the percentage by which the state's actual revenue exceeded the projected revenue for the 2021-2023 biennium.

The $5.61 billion kicker fund is the largest by far in Oregon's history, both in terms of the actual dollar amount and the percentage of the surplus. The previous record-holder by dollar amount was the 2019-2021 kicker, which had a biennial surplus of $1.898 billion, and the previous record-holder by surplus percentage was the 2005-2007 kicker, when revenue came in 18.6% higher than projected.

The rebate distribution next year will also mark the state's longest stretch of consecutive kickers since the law was created in 1979, according to the Department of Revenue's online kicker history page. Oregonians got a kicker from four budget cycles in a row from 1993 to 2001, but this year's kicker will be the fifth in a series that began with the 2013-2015 biennium.

The state can use a taxpayer's kicker rebate to pay any debts that they owe to the state such as child support, fines, school loans or prior unpaid taxes, the Department of Revenue noted. Taxpayers can also choose to donate their refund to an approved charity or the Oregon State School fund, although they must donate their entire kicker if they choose the latter option.