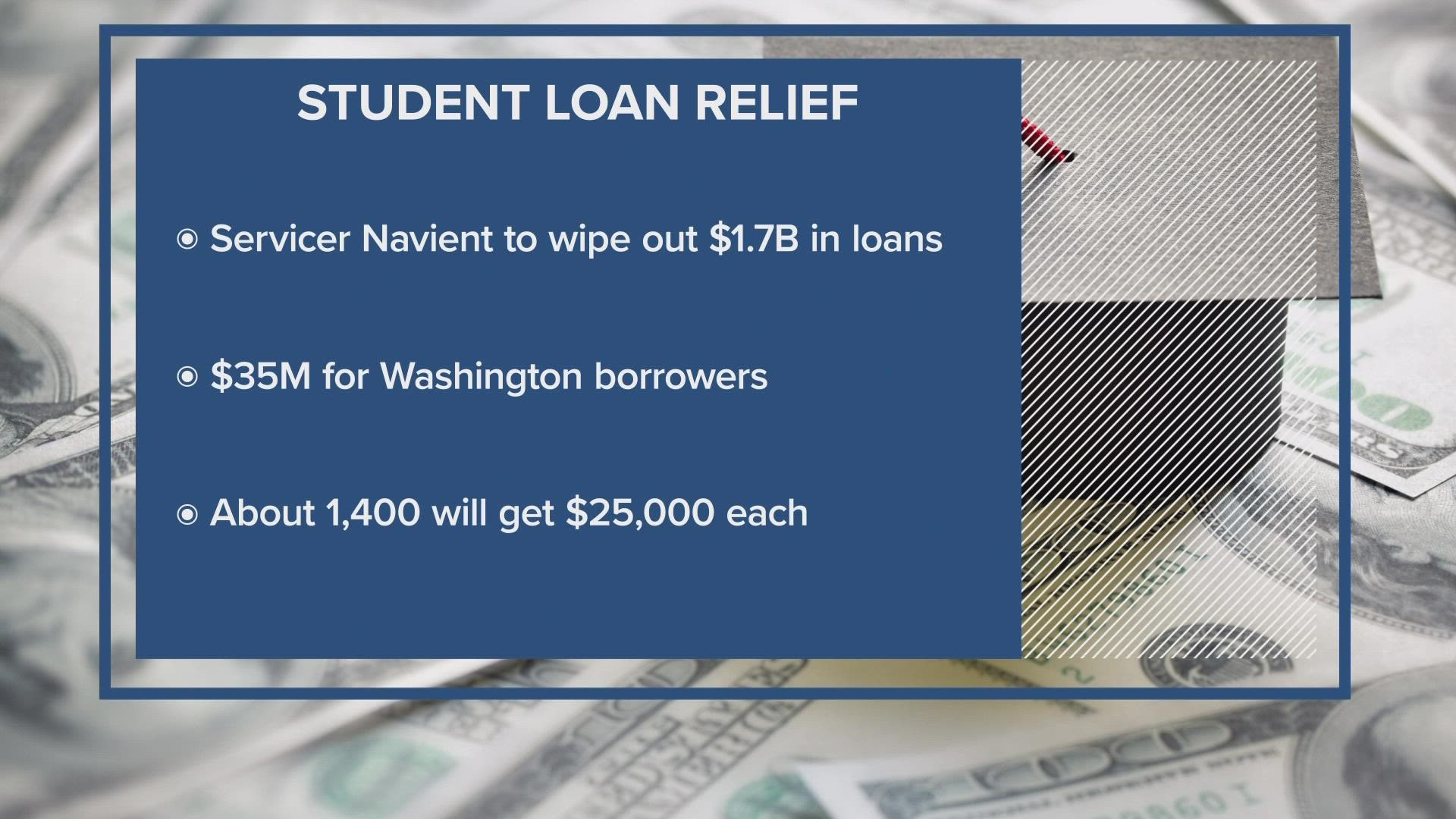

SEATTLE — Around 1,400 Washington residents will have their student loan debt erased, as part of a $1.7 billion settlement from a lawsuit led by state Attorney General Bob Ferguson.

Ferguson started the legal process against student-loan lender Navient years ago and 38 other states eventually joined the suit.

About $35 million is coming to Washington borrowers; on average, they'll each receive $25,000 of debt relief.

Ferguson said, among other things, Navient pushed people into plans that stacked interest on top of interest.

"When long-term borrowers who are in financial distress would reach out to Navient looking for assistance, Navient deceived them. (They) promised to help them as they dealt these long-term loans stretched over many years, but when students stopped making payments, that interest accumulated," said Ferguson.

He explained that the accrued interest was added to the principal of their loan, and then they would have to pay interest on that new total, going deeper and deeper into debt as a result.

"There were alternatives. Instead, Navient took the easy way out."

Ashley Hardin, a chef and food truck owner in the Seattle area, was one of the people deceived. She said ‘relief and justice’ were the two words that popped into her mind when she found out about the settlement. She’s hoping the legal victory enacts change in the $1.7 trillion student-loan industry.

"I'm sure Navient is not the only lender doing this," she told KING5. "I'm hopeful that this not only changes their practices but also opens up a (way) other for others to be looked at more thoroughly and make sure that they're on the straight and narrow, taking care of the students the way they should be."

In a statement, Navient “expressly denies violating any law, including consumer-protection laws, or causing borrower harm.”

If you’re one of the people who took out a loan through Navient between 2002 and 2014 – you don’t have to do anything. The company will notify you, and if you've made any payments since July 2021, you will be reimbursed.

According to the Consumer Financial Protection Bureau, student loans in the U.S. total $1.7 trillion, all told. If that were a national budget, it would be the 5th-largest in the world, after the U.S., China, Japan, and Germany.