PORTLAND, Ore. — Tens of millions of Americans are drowning in student loan debt.

If you're one of them, beware of a scheme on the rise. We've heard about scammers who say they're trying to help relieve debt, but are really just preying on vulnerable people.

The Better Business Bureau (BBB) Northwest & the Pacific reports a rise in student loan debt relief scams this time of year but, this time around, there's a twist. The BBB is seeing the scams carried out by actual people more and more, not just robocalls. That increases the risk more people will fall victim.

We do want to be careful and point out that not all debt relief companies are considered scammers, but there are bad actors out there.

Scammers will reach out to borrowers any way possible. People are reporting getting calls, emails, texts and letters offering fast relief because of something like a change in a law, policy or administration, or they warn forgiveness programs will end soon.

The Federal Trade Commission (FTC) has shut down schemes luring people with false promises of helping pay down loans faster, cheaper or get rid of them entirely. Those companies lied about taking over the servicing of loans, according to the FTC, tricking people into paying them directly. The FTC alleges those so-called companies diverted the money to their own pockets.

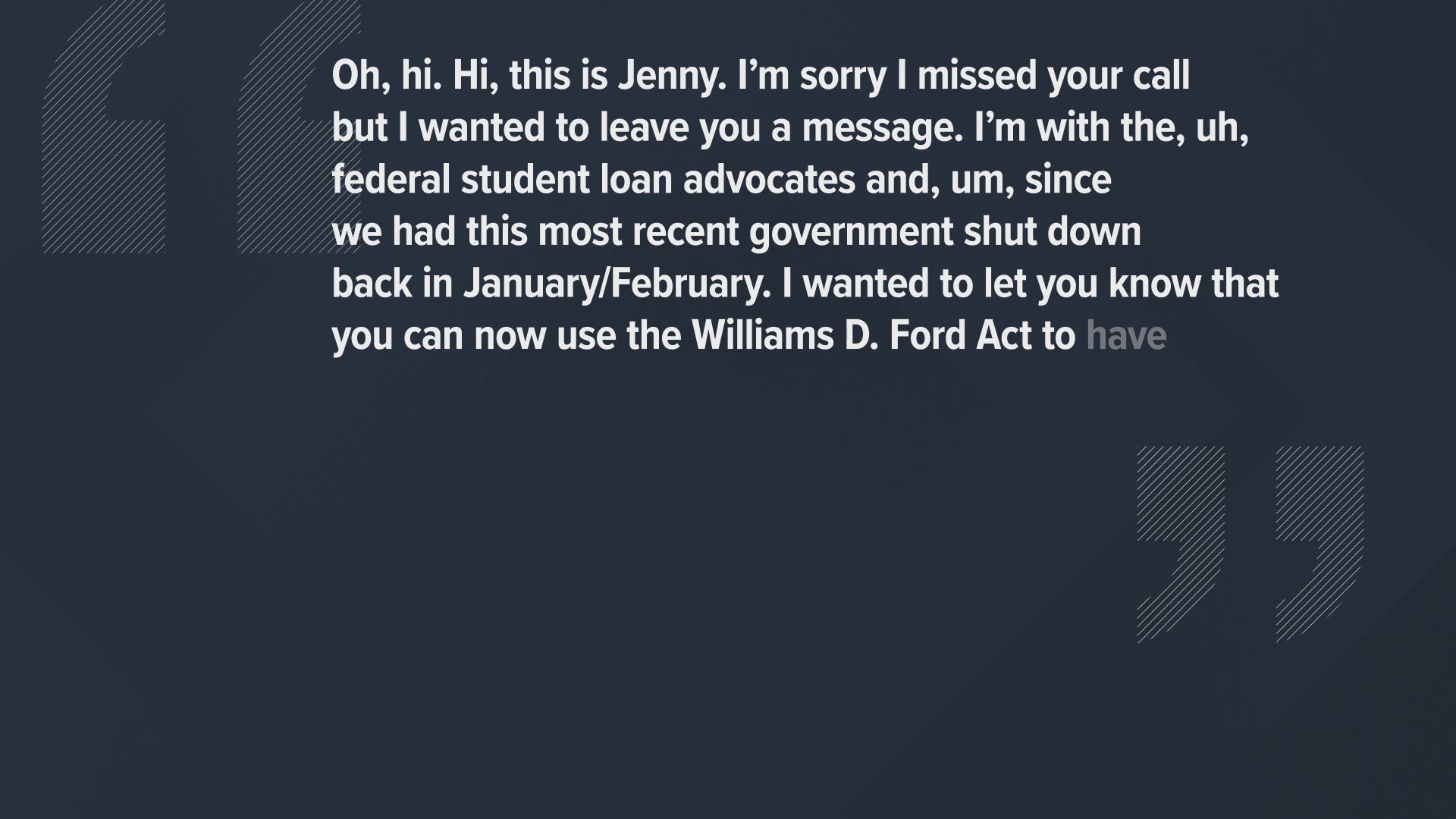

A BBB employee received a voicemail from someone claiming to be a student loan advocate, but the BBB flagged it as a scam. The person said:

"Oh, hi. Hi, this is Jenny, I’m sorry I missed your call but I wanted to leave you a message. I’m with the, uh, federal student loan advocates and, um, since we had this most recent government shut down back in January/February I wanted to let you know that you can now use the Williams D. Ford Act to have the balance of your loans wiped out and all your future payments halted. So, when you get this message please call me back..."

When KGW investigative reporter Morgan Romero called the number back, it wasn't in service and we couldn't find anything about the company online.

The BBB and FTC advise you to be skeptical of anyone calling you with aggressive tactics to get rid of your debt.

"There’s really no reason for someone from the department of education to call you to bless you with student loan forgiveness,” said BBB Northwest & the Pacific Portland Marketplace Manager Danielle Kane. “There’s really only a small percentage of the population that even qualifies for student loan forgiveness so it’s really unlikely that you’re getting this call out of the blue. And there’s really no reason for them to call you to defer your loan or to restructure your interest or to refinance unless that’s something you have sought out.”

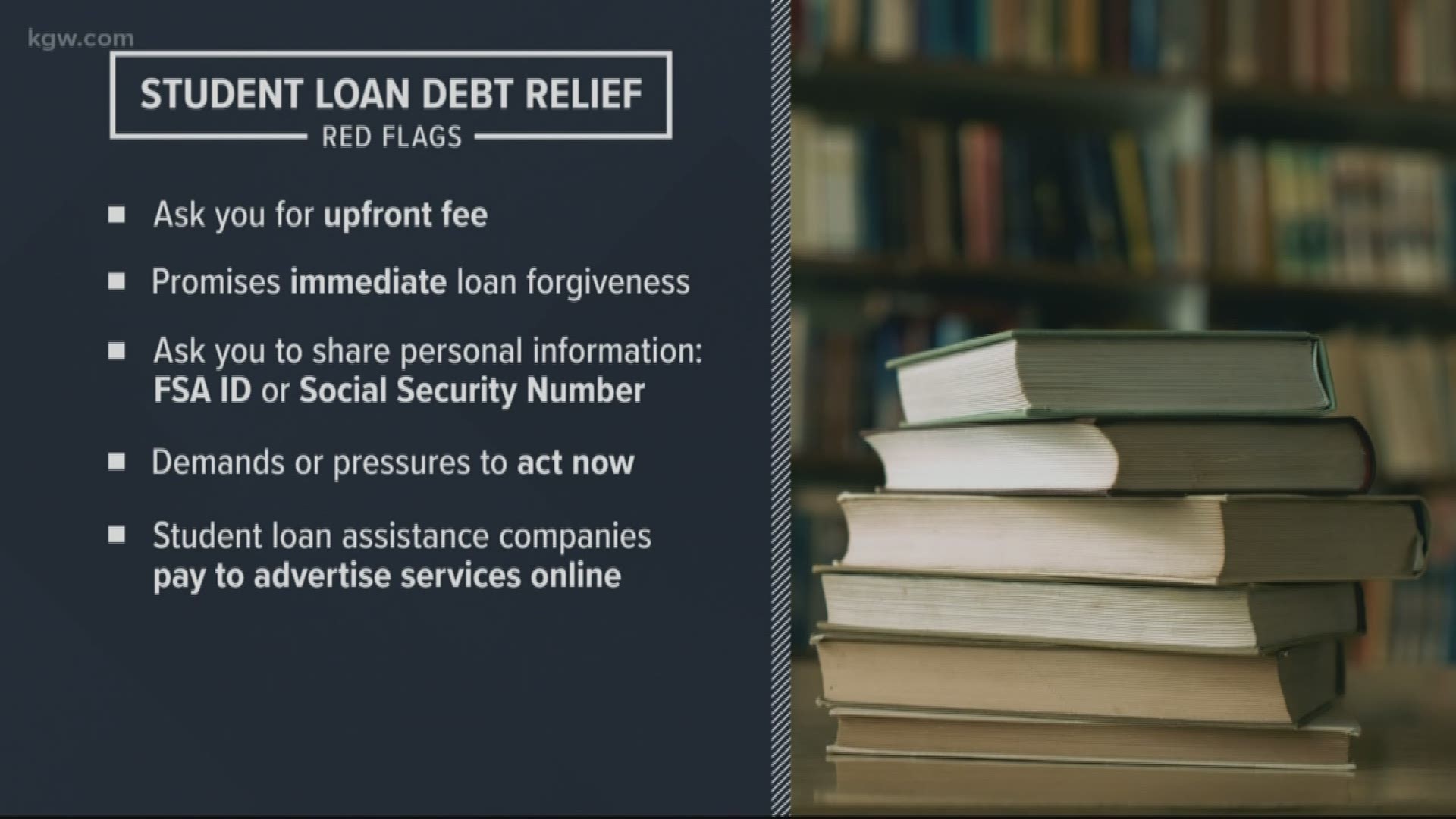

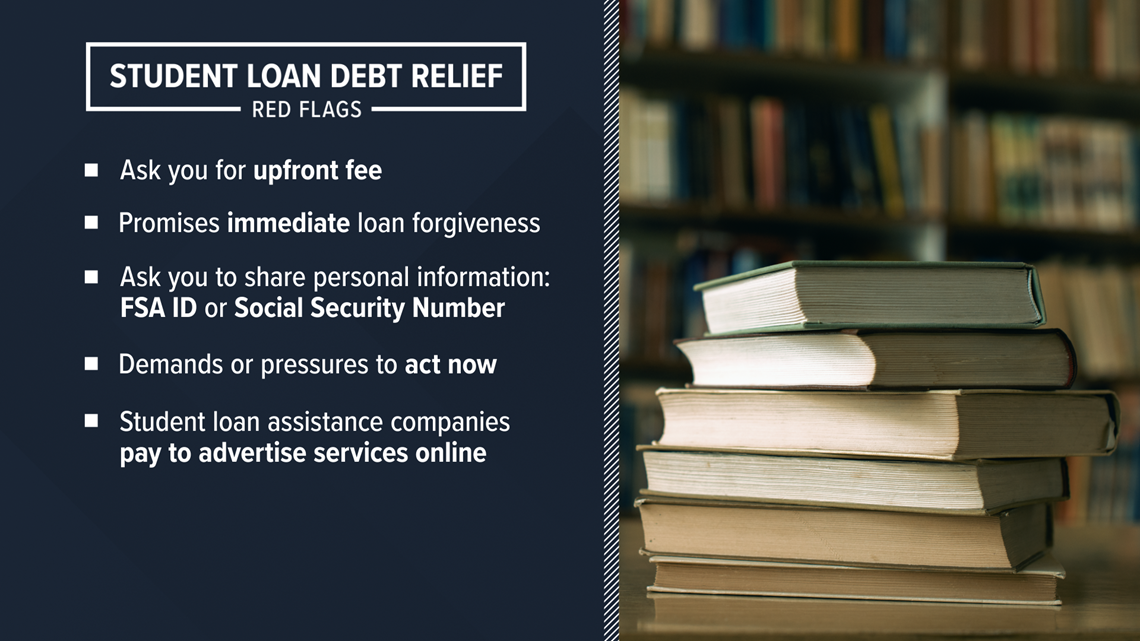

Warning signs to watch out for

- The biggest red flag is somebody tells you to pay an upfront fee to lower or get rid of your debt before they ever prove they can help you.

- Beware of anyone promising quick action to forgive your loan. There are legitimate programs to eliminate your loans but they take time and only some people qualify.

- A salesperson may pressure you into signing up with a sense of urgency. The Federal Student Aid office says no legitimate loan programs are available for a limited time. The U.S. Department of Education Federal Student Aid office warns of these examples of false claims made over the phone, email, text or mail:

- “Act immediately to qualify for student loan forgiveness before the program is discontinued.”

- “Your student loans may qualify for complete discharge. Enrollments are first come, first served.”

- “Student alerts: Your student loan is flagged for forgiveness pending verification. Call now!"

Communications using aggressive advertising to lure borrowers are not coming from the Department of Education or its partners. - Be careful if someone asks you to share private information. Some companies ask for your Federal Student Aid ID (FSA ID) or Social Security Number so they can sign into your account and make decisions for you. Not all of those companies asking for that are scammers, but you should never give out personal information like that.

There are actual private student loan debt relief companies that provide loan management services for a fee and aren't going to steal your money. Their services are often compared to tax preparation companies. When people’s loans are complicated, they often want help.

But the government wants you to know there is nothing a company can do that you can't do on your own for free.

If you are looking to make changes, sign up for a re-payment plan, or consolidate your loans you can do all of that on the Federal Student Aid Website.

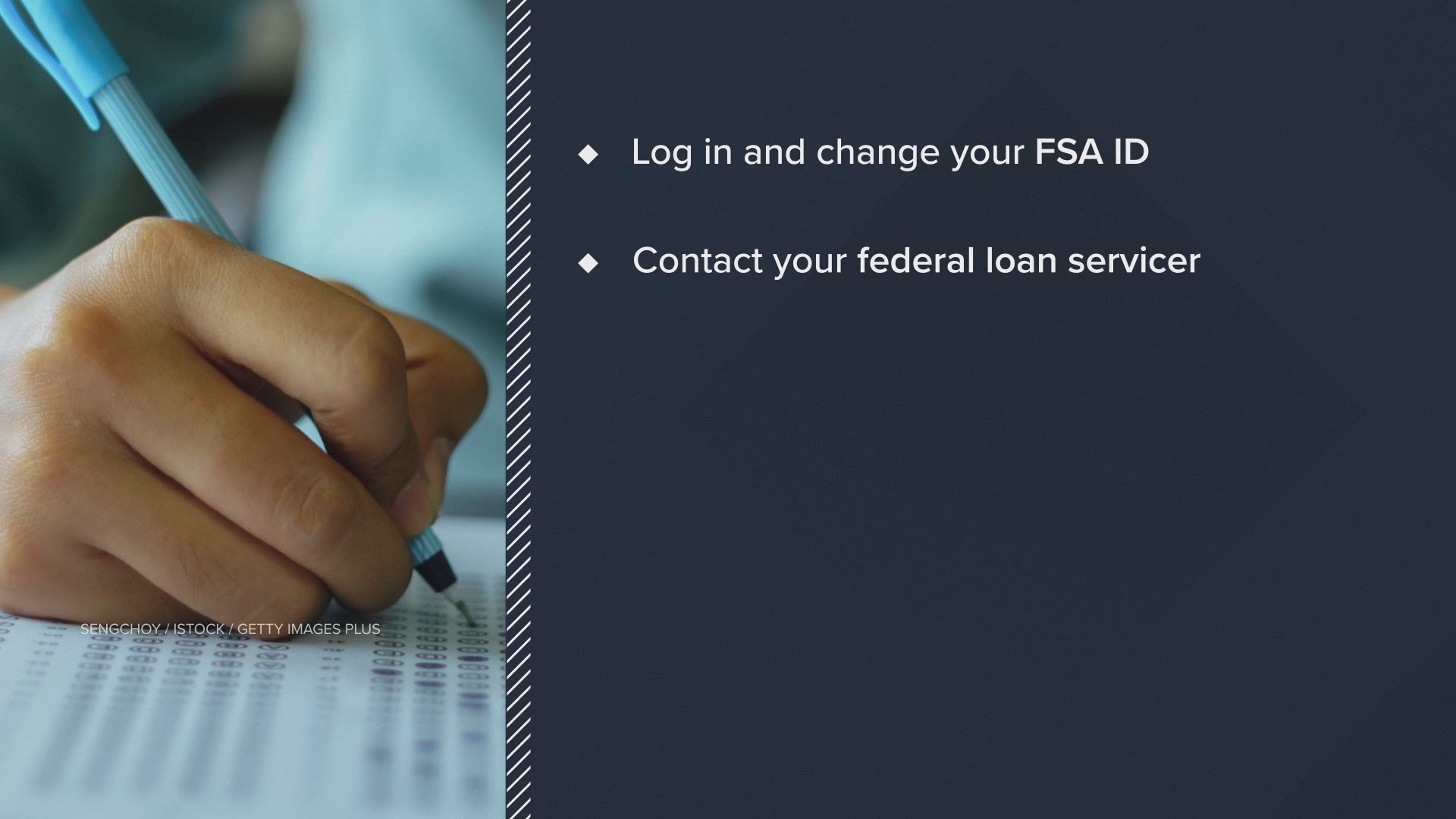

What to do if you've already shared information or paid a company

There are things you can do right away.

- If you've already given away your FSA ID: log into your account and change it.

- Reach out to your federal loan servicer directly.

- Contact your bank or credit card company and ask to stop any payments .

- File a complaint with the Consumer Financial Protection Bureau and Federal Trade Commission

Here is a list of trusted loan servicer companies the U.S. Department of Education works with to provide student loan services