SALEM, Ore. — Oregon's projected "kicker" tax rebate will decrease by $108 million under a bill passed by Democrats in the state Senate.

The Statesman Journal reports that for individual taxpayers, that would translate to a 14.5 percent reduction to their kicker rebate when they file their taxes in 2020, if state economists' most recent revenue forecast holds.

House Bill 2975 was passed by the Senate Monday. It already passed the House and is headed to Gov. Kate Brown, who must decide whether to sign it into law. Brown's deputy communications director Kate Kondayen declined to say whether Brown plans to sign the measure.

In February, economists predicted the kicker could reach $748.5 million. It represents the amount of taxes collected above and beyond what state officials projected they would take in before the start of the two-year state budget cycle.

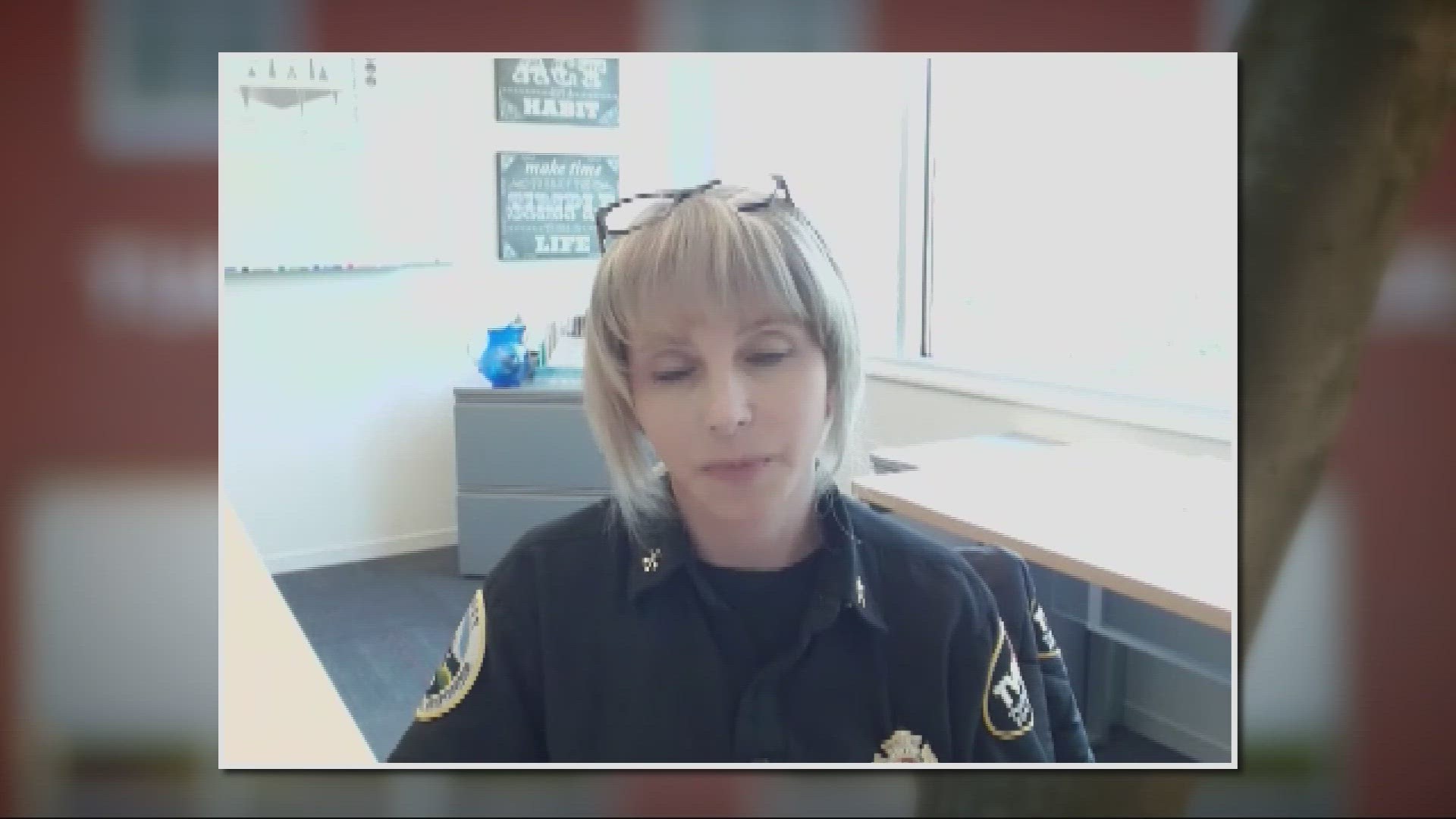

KGW Political Analyst Len Bergstein says the kicker is a matter of policy and politics.

The policy is that the state should not take more than its fair share of taxes from the public. If revenues come in 2 percent higher than projected two years earlier, then that money goes back to taxpayer.

"The political part is that Republicans always like to say that Democrats always take too much money from the voters. Therefore, anything that’s over that 2 percent should go back to the voters. That’s where it belongs,” Bergstein said. “Democrats say, wait a minute, two years in the past is a tough time. We try to get as close as we can, and we still need all of the money we collected in taxes. So, if there’s a little bit over, like $100 million in this case, we’re going to send that into programs that really matter for the state.”

Bergstein says that this bill opens the door to a bigger question: Should Oregon have a kicker tax rebate at all?

“We’re exposing ourselves to the real problems of the kicker as a smart policy,” he said.

Projecting revenue two years in advance has politicians playing a tricky game and funding state programs could be the loser.

“Well, if we guess right -- we’re going to keep all the money. If we guess wrong -- we’re going to give it back. There are very few states who operate their finances that way,” Bergstein said. “We’ve had some years in the past where we were giving back millions and millions of dollars and then the legislature had to come in and they had a budget deficit. So, they couldn’t balance the budget.”

It’s a question echoed by the public as well.

“I always kind of wondered why they did it. Why not just use it in the general fund? That or just lower our taxes and let us keep our money that way,” Jonathon Antonson of Salem said.

Governor Brown has not yet said whether she will sign the bill or now, but Bergstein says he does not see why she wouldn’t because that money would go to programs that the governor supports.